Gainful

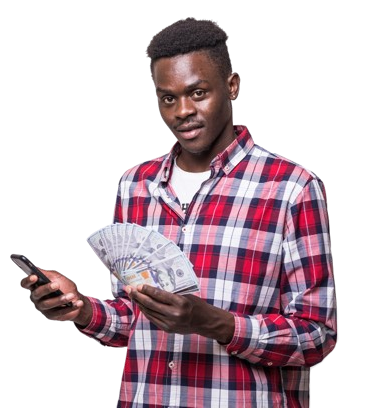

Effortless and speedy, accessible from any location. Only one document required

Effortless and speedy, accessible from any location. Only one document required

A direct lender with a modern approach to reliability. We secure your data and support you in challenging conditions

Simple home-based solutions quickly. Funds transferred immediately with flexible loan durations

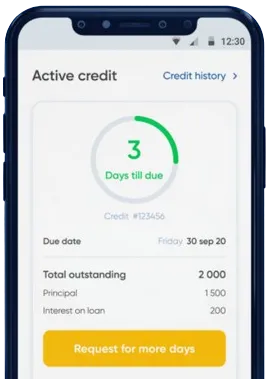

Place your request via our app, just by filling out the form.

Wait briefly for our decision, typically 15 minutes.

Get the funds. Transactions are generally completed in one minute.

Place your request via our app, just by filling out the form.

Download loan app

Managing financial emergencies is crucial for many Nigerians, as unexpected expenses can arise at any time. In such situations, urgent loans can be a lifesaver, providing quick access to funds to alleviate financial stress. These loans hold several benefits for individuals who find themselves in need of immediate financial assistance.

One of the key advantages of urgent loan in Nigeria is the fast approval process. Traditional loans from banks often involve a lengthy application process, requiring extensive paperwork and credit checks. In contrast, urgent loans can be approved within hours, allowing borrowers to access funds swiftly.

This quick approval process is particularly beneficial for individuals facing urgent financial needs, such as medical emergencies or unexpected bills.

Urgent loan in Nigeria offer flexible repayment options, allowing borrowers to choose a repayment plan that suits their financial situation. Whether it is a short-term loan with a quick repayment period or a long-term loan with lower monthly installments, borrowers have the freedom to select the option that works best for them.

Moreover, some urgent loan providers offer grace periods or extensions for repayment, providing borrowers with additional flexibility in managing their finances.

Unlike traditional bank loans that often require collateral, urgent loan in Nigeria typically do not necessitate any form of security. This makes these loans accessible to a wider range of individuals, including those who may not have valuable assets to offer as collateral.

By eliminating the need for collateral, urgent loans provide a viable borrowing option for individuals who require immediate funds but do not have assets to pledge.

Applying for urgent loan in Nigeria is a simple and hassle-free process. Most loan providers offer online application portals, allowing borrowers to submit their applications from the comfort of their homes. This convenience saves time and eliminates the need to visit physical branches or submit extensive paperwork.

Urgent loan in Nigeria offer a host of benefits for individuals in need of quick financial assistance. From fast approval processes to flexible repayment options and no collateral requirements, these loans provide a practical solution for managing unexpected expenses. By understanding the benefits of urgent loans, individuals can make informed decisions when faced with urgent financial needs.

An urgent loan in Nigeria is a type of loan that is quickly disbursed to individuals who are in need of immediate financial assistance.

The requirements to qualify for an urgent loan in Nigeria may vary from lender to lender, but typically include proof of identity, proof of income, and a valid bank account.

The approval and disbursement of an urgent loan in Nigeria can vary depending on the lender, but some lenders can provide funds within 24 hours of approval.

The maximum amount you can borrow with an urgent loan in Nigeria will depend on the lender and your financial profile, but it typically ranges from ₦50,000 to ₦5,000,000.

Interest rates for urgent loan in Nigeria can vary widely among lenders, but they typically range from 5% to 30% per month.

Yes, there are penalties for late repayment of an urgent loan in Nigeria, which may include additional fees, increased interest rates, or even legal action by the lender.